- Is your home 2001 or older?

- Would you like to have lower home insurance premiums and greater peace of mind that your home will be safe during Florida storms?

If your answers are YES, you would need to start with a wind mitigation inspection.

The average cost of $75-$150 and an hour of your time, homeowners have the potential to shave hundreds of dollars off home insurance premiums and also gain pointers for making their homes safer during hurricanes.

A wind mitigation inspector is a licensed and certified building contractor, architect or engineer who will take a close look at your home from the windows up. This inspector will need ask for access to your attic or crawl space. They will also need to know the year your home was built and if any construction modifications have been made.

The inspector will likely start with a trip to your roof to determine the type of covering material and structure. The roof deck attachment will be analyzed, which means the inspector will determine the nail pattern used to attach your roof. He or she will also determine the way your walls are attached. Certain materials and nail patterns hold up better than others during high winds. Therefore, the type of materials used on your home and the way they are attached will determine how much of a discount you could receive from your insurance premium.

Your inspector will determine if a "Secondary Water Resistance" material was used between your covering material and roof deck. If any part of your roof is damaged, this material helps to better protect the interior of your home and can significantly reduce your premium.

Finally, the inspector will look at the windows and doors, including garage doors, sky lights and glass block. Having hurricane shutters or pre-cut plywood that meets code regulations for thickness and quality can mean further discounts for you.

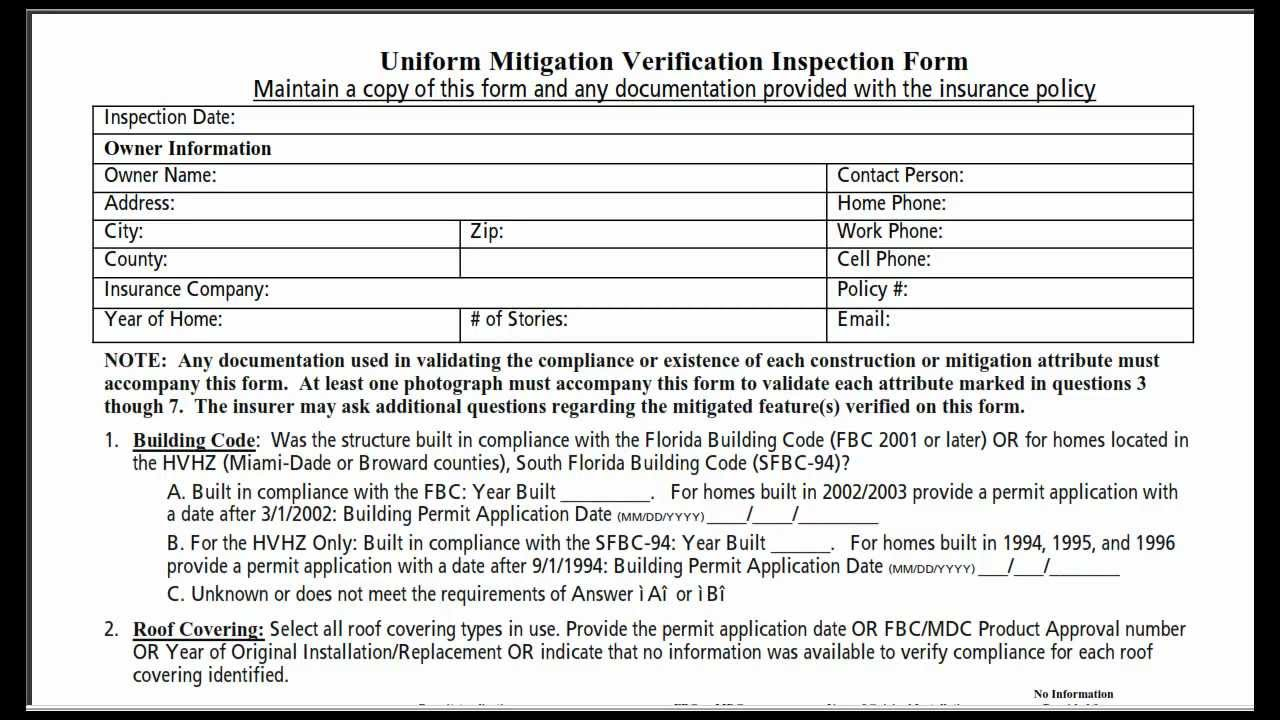

Your inspector is required to take and give you pictures as well as complete a standardized form that you then send to us, your insurance agent. A Wind mitigation is good for five years or until any repaires, improvements or damages effect the roof.

You are welcome to all any licensed inspector in your area. If you do not have an inspector in mind, we invite you to call your Personal Lines Account Executive at Waldorff Insurance and Bonding today for our preferred list of local inspectors to assist you.